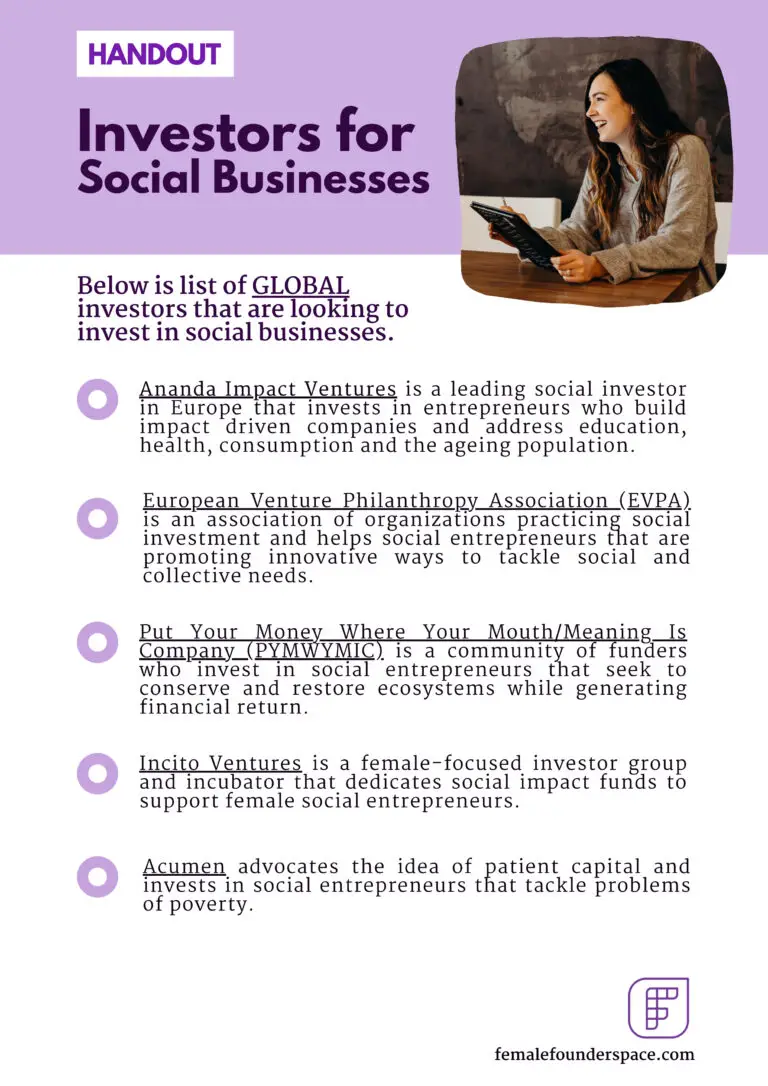

Investors for Social Businesses

Social Investment

However, getting funding as a social business is tough. Traditional investors see the social component of a social business as a discount on their return on investment. Moreover, if there’s a financial cost to this social component, it’s viewed as a risky investment choice. However, this doesn’t mean that you’re left with nothing as a social business, there are still a pool of venture capitalists and angel investors that evaluate a business based on its social and environmental performance as well as its financial success. This is known as social investment – an investment strategy that considers both financial return and social impact to bring about change.

Differentiate Angel Investor and Venture Capitalist

Now you may be wondering what is an angel investor or venture capital firm. And what is the difference between them?

Let’s define the two below:

According to PWC (2014), an angel investor is someone who invests in an organization based on ideological considerations. Meaning, the social mission of the investment target is the primary objective of an angel investor. That is, they focus strongly on social return before financial return. Hence, they often provide financial aid to start-ups and the amount of capital invested is relatively small, which means the risk for the angel investor is low. The capital can be a one-time financial injection or ongoing support to carry the company through difficult times (e.g. the start-up period). Angel investors can be among your family members or established foundations.

Alternatively, a venture capitalist is someone that invests a large sum of money in start-up firms and small businesses with expected long-term growth potential. Though the risk for investors is high, they assume that these would have potentially high returns, both in the social as well as financial aspects (PWC, 2014).

What investors are looking for?

But what exactly are these investors looking for? What are the most important aspects to consider to successfully raise funding from investors as a social entrepreneur?

We have compiled a few key points below from the report of PWC (2014):

- Align your financial and social objectives. There is no such thing as a trade-off. People often say that you can’t do good and make a profit. That’s not true! You should be able to present an important social mission but also a convincing business case. Together, these two make an attractive financial return to expand your impact and potential investors will see that. Investors expect you to have a clear understanding of your social goals and your business model so be prepared to pitch a firm stand on these two points and how this will result in financial returns!

- Build and bring forward a well-managed and well-balanced team. Having a good team that is committed to your social enterprise, rather than working on your own, presents a strong case to potential investors. It shows that others believe in your mission and are willing to invest their time and effort for one common goal. This team should show a balance of complementary skills with you acting as a level-headed leader. This helps convince your investors that if you have people standing behind you on your social mission, then likely, customers will do the same.

- Measure your impact. This may be difficult to do, but you should measure and project your outcomes. This helps you keep focused so that your actions are in line with your goals. Investors are not looking for big impact measurements especially if you are in your early stages or if you’re a growing business. Start small! Just by measuring your impact, you are already showing potential investors that you have some kind of quantifiable assessments they can bank on.

- Don’t drift away from your mission. Mission drift occurs when a social enterprise drifts away from its initially communicated social mission. This can happen over time and may even occur when the focus of a social enterprise shifts from balancing financial gain and social gain to prioritizing more financial gain. This may be alarming to potential investors as they have certain expectations of what your business is all about. Remember to present a firm ground to your investors about the sustainability of your social business and why mission drift won’t happen!