Lesson 3 of 7

In Progress

Shift Your Money Mindset

You are now ready to learn what it takes to shift your Money Mindset in the right direction. In this lesson, our expert will reveal clear steps and tools to confront and overcome your money beliefs. Also, a worksheet will guide you through the discovery of your money beliefs and the transformation process. At the end of this lesson, you will finally be able to identify and adopt the right Money Mindset to make more positive financial decisions in your life!

Transcript

With every mindset that you have, and it doesn’t only have to be about money, it can be about romantic relationships or your career, or, you know, wanting to plan your life versus not.

The first step consists of becoming aware. It’s like taking stock of where you are right now. What we found very helpful with respect to the money mindset is to actually do a couple of written exercises even by hand, because that is so much more effective to become aware of your money mindset. And the book “Emotional Currency” is full of exercises, very precise exercises that help you reflect, reflect on how was money connotated in your family of origin, right. Did your father always say there isn’t enough money to go around? Or did your mom always say money is dirty? Or did you always talk about that one pal that is super affluent, but she doesn’t want to share her wealth.

So to become aware of these stories that circulate in your family, and then to really sit down with yourself, maybe have a nice coffee and write down your money beliefs. I find myself know that one of my money believes in the past was that I can only make money when I worked for a bank, right. I always thought: Okay, as an entrepreneur, it’s going to be really difficult to make money, but, hey, why don’t I work for a big established bank? I will always be able to make money there. Or, hypothetically speaking, I can imagine that a lot of women don’t have a money mindset or money belief that says I’m not worth more than a hundred thousand euros per year as a salary. So really, the first step is to become aware.

The second step could consist of little experiments. If you want to change your mindset, you cannot expect your brain or your mind to change within a couple of days, you kind of have to convince it to adopt a different mindset. And that could consist of little experiments that show you, yes, it’s possible to change my mindset. For instance why not talk to your boss at the end of the year and ask: Hey, I have had A, B and C achievements, I’m really worth more money and to really negotiate and see, where does that get you? And ultimately, if that experience is successful, then something is going to change about your money mindset, because you will realize: Oh, I am worth more than I expected. And other people actually recognize that.

Or another shift in money mindset could come about when you finally create that side hustle and develop a product, and it could be an online learning product, or it could be making dresses, or it could be learning how to code and selling your services on the side. And then once again, you see that people are willing to pay for your services.

Or another one could be you had the money mindset that investing is way too complex and you will never get there. And then all of a sudden you do attend a workshop on the basics of investing and you realize: Oh, okay, it’s really not rocket science. And I can set aside €100 a month and, for instance, invest it in an ETF and make money with that. And that way bypass annual inflation and make my money work for me.

So if you engage in a lot of these experiments and also check in with yourself, let’s say every three or six months, and maybe even have like a money mindset journal where you check in on yourself, that can really be helpful.

Another thing that members of the Finelles community have found very, very helpful in the past and continue to, is to actually talk to your friends about money. It always seems to be such a taboo and women in particular don’t really dare to talk about it, but it’s actually a really good idea to just talk to your friends and actually ask them: how much do you make, or if you’re a freelancer, how much do you charge per day? Do you charge half days or full days? Have you actually thought about your taxes? And the more you make it normal for you, but also for your peer group to talk about money, the more that will help you start shifting your mindset.

I know that there is an acquaintance of mine in Berlin, who just makes a lot of money. And another friend of mine always admires her, but would never dare to actually adjust her hourly wage. Even though she can tell that this other person makes twice or three times of how much she makes. So it’s another example of not only admiring what other people do, but actually also reaching out to them and being like: Hey, you make so much money, I really admire that, how did you get there? What are the steps you took?

You can find a money buddy. That’s a really cool concept as well. It can be somebody that makes pretty much what you make. And then you just keep each other in check and maybe talk about emotional spending, right? Or talk about how you manage your salary negotiation. You can also join one of the Facebook groups that are focused on money and improving your money mindset.

What we also found quite helpful is to actually not only become aware of your emotions and all of your beliefs, but actually confront them in a very pragmatic manner.

So, look at your cash flow each month, find one of the Finelles forms that help you to actually write down how much comes in every month and how much do you have to pay. Determine your net worth. Sit down with your former roommates like I did once and inventorize all of their expenses and their revenue with them to understand what is the distribution of their capital and how much money is actually left for retirement.

And then specifically retirement either, first of all, do an inventory yourself: how much have you already contributed to various public pension schemes? Or how much are you willing to set aside investing in private schemes? Or if you don’t feel confident enough, then find yourself a versatile financial advisor that will go through this with you.

Because once again, it’s all about taking charge, being in control of your life and money is such a huge part of it in our modern society that becoming confident around money and finding practical ways of translating your money beliefs into positive action steps will greatly help you. And we’ll make sure that when you’re 65 or 70, you’re doing okay, but you don’t have to worry because that’s ultimately the goal.

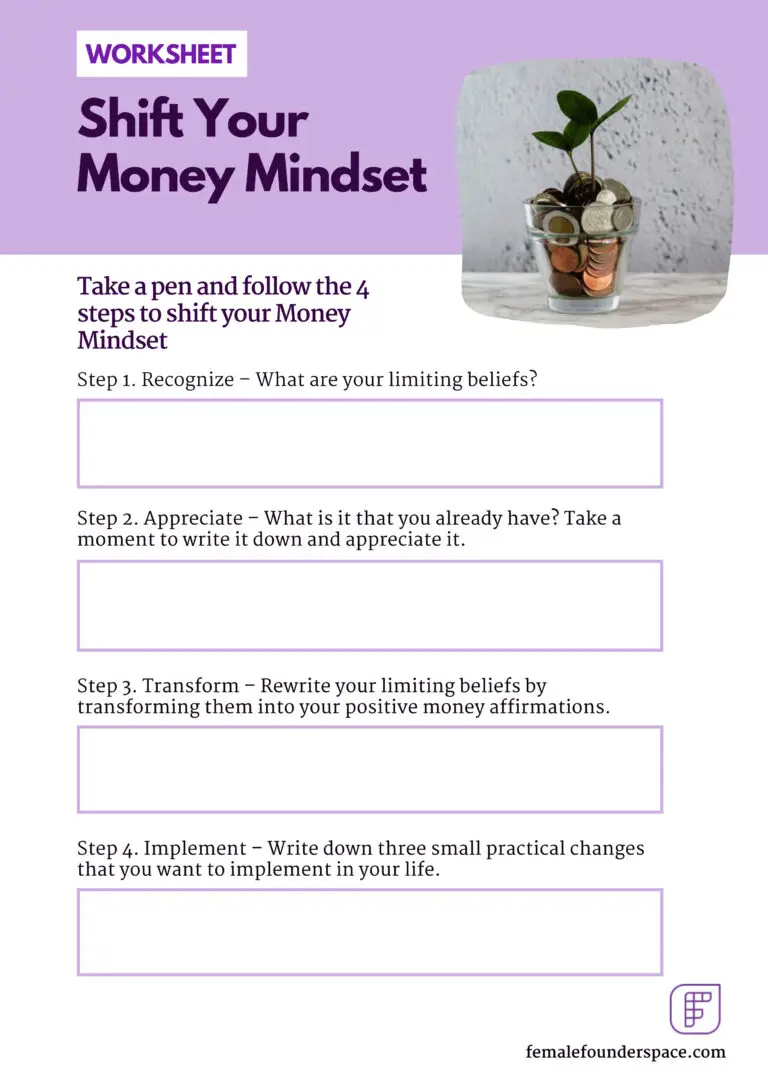

Now that you know what a Money Mindset is and, most importantly, you are aware of your own, you are ready to take control of it. As you already know, it is not about how much money you have. It is all about your mindset. Therefore, grab a nice coffee or tea and dedicate some time to fully embrace the Abundance Money Mindset with our 4 steps worksheet. Be honest and have fun!