Lesson 4,

Topic 4

In Progress

Set Your Smart Financial Goals

Lesson Progress

0% Complete

Transcript

The first step of financial goal setting is actually defining goals. So why do we need the goals is to keep track of it and actually to reach something which we can be really aware of. So this is the first step to success. We have different types of goals. So, we have short term, medium, and long term. I prefer actually to start with the long term to break it down to medium and then to short term. So, you think forth and back to reach everything you want. What is really important if you want to reach something or your dream is that you make it accessible for yourself. So, if I’m just saying today, I want to be a millionaire. This is too vague. I really need to say when and why. And it really needs to be my priority and focus over time. So, if I’m taking a simpler one, is like I want to reach financial independency by forty for example, that means I have now 14 years to go. This is my long term goal. If I break it down to medium goals, I really need to see which career path do I need to take. And for example one step could be my own company because I’m more financially responsible then, but really break it down into the short term because if the short-term goals won’t work then the entire construct is not working. And this is right now the most important and focus on priority for me is for example making the company work and this is like short term goals thinking like in six months and even break it down to one-month goals.

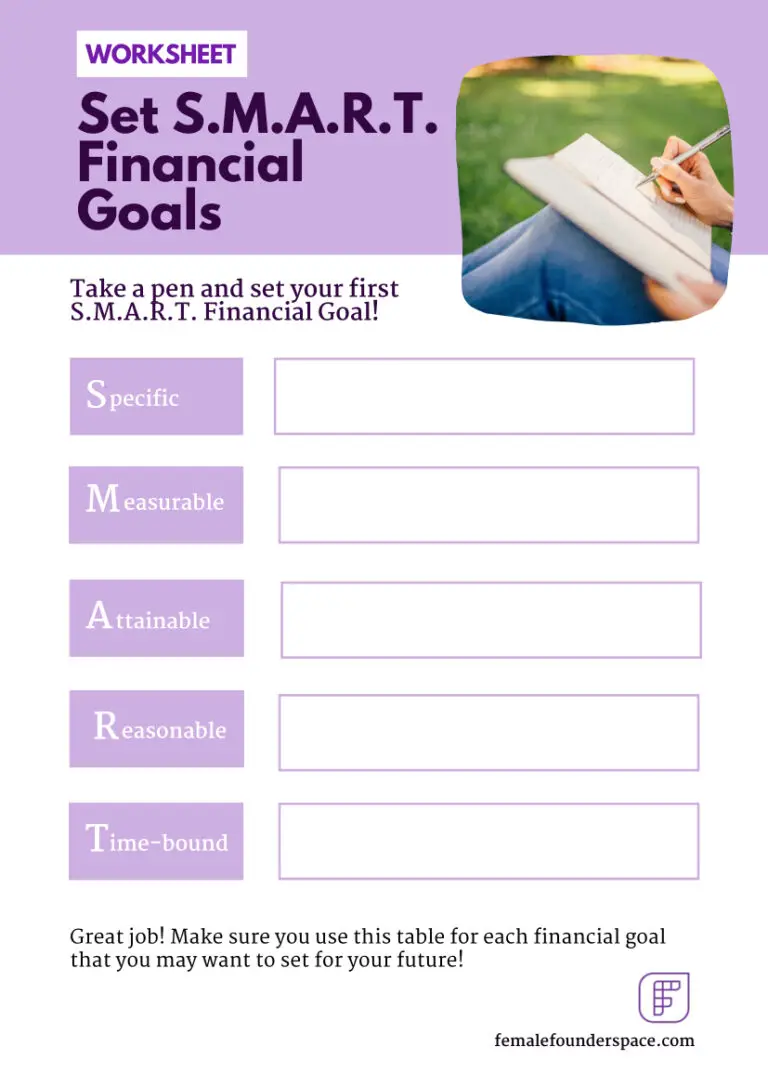

SMART goals, I don’t know if you know it but it’s the S stands for specific, the M for measurable, the A for attainable or achievable, the R is for realistic, and the T for timely or time bound. Why do we need to have SMART goals? It is really that we can measure it and break it down to actions. Because sometimes when we have long term goals, we actually miss the actions and steps we can do to achieve it.

Understand S.M.A.R.T. Goals

Now that you have computed your net worth, you have a better idea of your financial position. You are ready to make a financial plan for a healthy financial future. However, if you just have a vauge set of desires for your financial future, you will probably stugle to know what to do and understand if you are actually succeeding or not. Fortunately, the S.M.A.R.T. framework provides great support for creating a clear plan towards your objective. This will give you the structure needed to reach and track your objectives.

Let’s have a better look at each letter. Click on the words below to open their descriptions:

When setting your financial goals, you want to make sure that you really know in detail what it is that you want to achieve. Ask your self all the necessary questions to describe your goal as much as possible. Give yourself precise information, the more detailed it is the more likely you will be able to stick to it and achieve your goal. For instance, start asking yourself: Why is it relevant for me? By when do I want to achieve it? Do I need help from anyone? How do I intend to achieve it? What are its limitations?

Once you know exactly what you want to achieve, it is important that you decide how you will measure your progress. Ideally, you create several checkpoints along the way towards your final goal. For instance, if you want to save 8 000 euros within the next two years, you will make sure that every 6 months you saved 2 000 euros. Measuring your progress will be fundamental to adjust your actions and stay motivated on your way towards your goal. Ask yourself: what is the best way to measure my progress? How will I do it? How often? Where will I save the information?

This third step of the framework is your chance to really create an action-plan. It is fundamental that the actions that you plan to take are as much as possible under your control. Do not rely on expectations such as a raise in your salary or a friend helping you out. Also, try to forecast any factor that may interfere with your plan and decide on how you will take care of that. What are the actions that you will be committing to in order to achieve your goal? How will you make sure to stick to them?

Creating your action-plan provides you with a better understanding of what is actually within your personal reach at the moment and what is not. Take a moment to reconsider your goal and ask yourself if it is realistic. For instance, you may realise the amount you wanted to save in one year is too high for you at the moment, then break it down and aim at achieving the first half in one year and the rest in the a second year. Start small and thing big in the long-term to stay motivated and keep growing. Be honest with yourself: Is the goal I want to achieve and the action-plan to reach it realistic? How can I make it more realistic?

Time management is key to achieve your gaols. This last step of the framework is a reminder that, if you did not do it yet, you should create a time-bound structure around your action-plan. Once again, make sure your timeframe is relistic within your everyday life. What is the exact deadline for your goal? How often will you keep track of your progress? When in the day/month will you commit to certain actions?

Once you have created your Specific, Measurable, Attainable, Realistic and Timely goal, you are in control of everything you need to reach it. This means that you will be able to stay more focused and follow the plan, but it also mean that it will be easy for your to adjust the plan if needed. Remember to check in with yourself once in a while and don’t be too hard on yourself. YOU CAN DO IT !

After following the lesson on your personal finances, you are now ready to set your financial goals.

Below, you can download a worksheet with a table that will guide you though setting your S.M.A.R.T. Financial Goals!