Money Challenge & Useful Resources

Here are some platforms that you may find helpful:

Investopedia: This very popular website provides a very clear explanation of several financial topics. This information is communicated through articles and videos, which make learning more interactive and fun.

FinMarie: Combining personal financial advice with an online investment solution, FinMarie is the first online investment solution made by women for women in Europe.

Mind the gap: Mind the gap is a financial education group for all women with the mission of supporting women to achieve their financial and investment goals.

Finelles: Finelles is a learning community for women who want to acquire financial knowledge and financial competence.

Ellevest: Ellevest was designed specifically with the mission of closing gender money gaps by encouraging women to invest. To reach this mission, they provide a platform with a robot-advisory service through both their website and their mobile app.

Madame Moneypenny: Madame Moneypenny aims to provide financial independence for all women. Their platform supports females to improve their financial management and to do it independently.

InvestHers: This early-stage investment firm supports women by partnering with female entrepreneurs and also investing in their small businesses. Additionally, they provide support by offering their expertise in sales development.

3 of the most enlightening Ted Talks about money

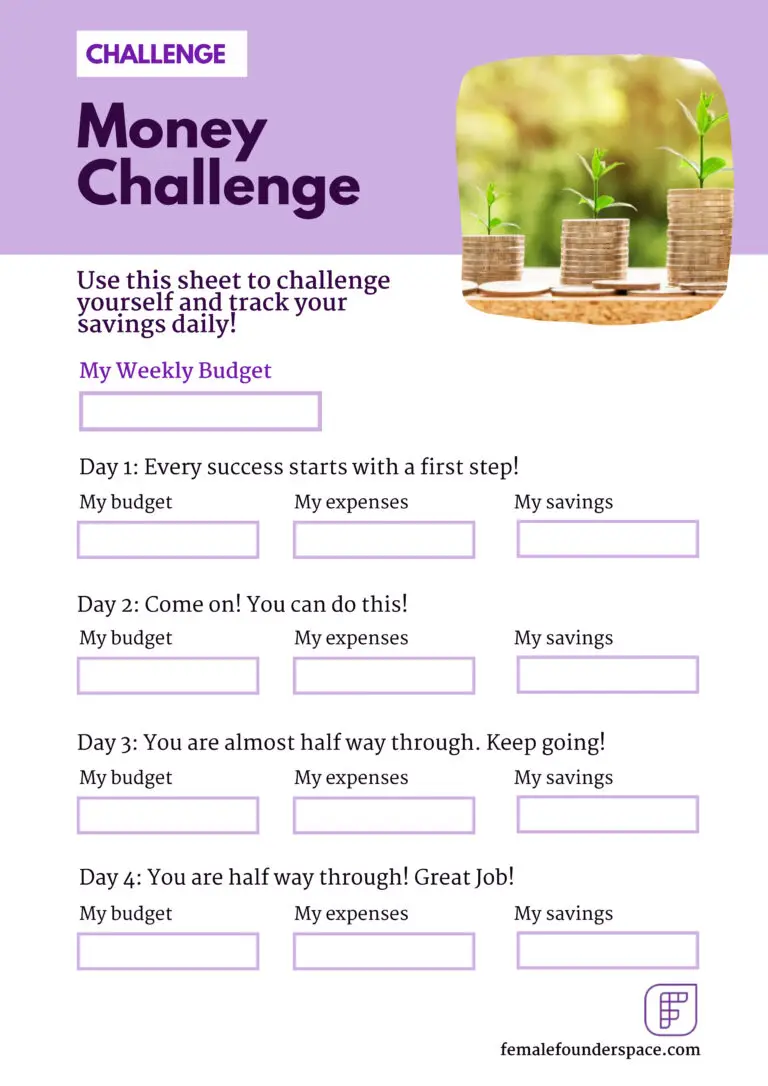

And now, here is our Money Challenge for you!

This is your chance to challenge yourself and put into practice some of the concepts you have learned during the course. We challenge you to set a short-term financial goal of 7 days and follow the plan.

To start the challenge, use the table that you can download below to estimate your weekly budget and then split it between the 7 days. Once you fill all the boxes regarding your weekly and daily budgets, the challenge has officially started! At the end of each day write down how much you have spent, then subtract it from the daily budget to compute your savings.