Lesson 5,

Topic 2

In Progress

Step 2 – Organize Your Business Finances

Lesson Progress

0% Complete

Transcript

Accounting plays a vital role in business. It allows you to track all sorts of information and all business transactions can be translated to accounting. So all the transactions will fall into the categories that will be mentioned in the documents later on.

Your balance sheet is also referred to as the statement of financial position, and it will reveal your situation at a specific point in time. Let’s say you pick a date such as December 31st, and it will show all of the transactions recorded up until that date. So your balance sheet will show you your assets, your liabilities, and your equity. Assets are somethings that you own, and they are anything from cash to property, plant and equipment and also prepaid expenses such as prepaid legal fees, or prepaid advertising, and things like that. Liabilities are obligations of the company so they are what you owe, and they are invoices you have to pay next week or next month or next three months, and they also include long-term things such as a property loan or a long-term loan. And you also have your equity, which is money that you have put into your business. So it will include capital and it will also include any accumulated results that you have been accumulating throughout the years or months.

The income statement will show the profitability of a company. Compared to the balance sheet, the income statement is information within a period of time. You want to know if you were profitable or not during the month of January. So for the month of January, you will compare your revenue to your expenses and that will give you a profit. That’s how you will know if you’re profitable or not. So you can categorize your expenses and that way you can compare them. You can see if your electricity varies from month to month, or if we have peaks of advertising by comparing them month to month or even year to year.

The statement of owner’s equity is something that most companies look at on a year basis. It’s not analyzed like the income statement or the balance sheet, because there is not much change most of the time. If you have a new investor maybe your equity will change and you can also see your different accumulated results throughout the time.

A revenue forecast is an estimate of your revenues over a fixed period of time. This can be from six months up to a year, and you can look at your past operations in order to help you better forecast your revenues. Having this will allow you to plan your expenses. In months in which you are expecting a low revenue, maybe you can cut some expenses and think about starting a financial planning.

As we have talked, accounting has many transactions that need to be recorded, and an accounting software is a tool that will allow you to not make any bookkeeping mistakes, which are very common with the different transactions that a business can have. Using a accounting software is time efficient and it’s user friendly, and it will allow you to reduce cost of bookkeeping mistakes. There are many accounting softwares available, from ones that manage low volume of operations to huge amounts of volumes of operation. And you need to look at the industry in which you’re in, you can also ask around some are very user friendly, some are very cost effective. So you need to find out what is best for your specific business. There are also some people that will work with you to make it specifically tailored to your needs. So you definitely need to look around and consider a few things when choosing an accounting software.

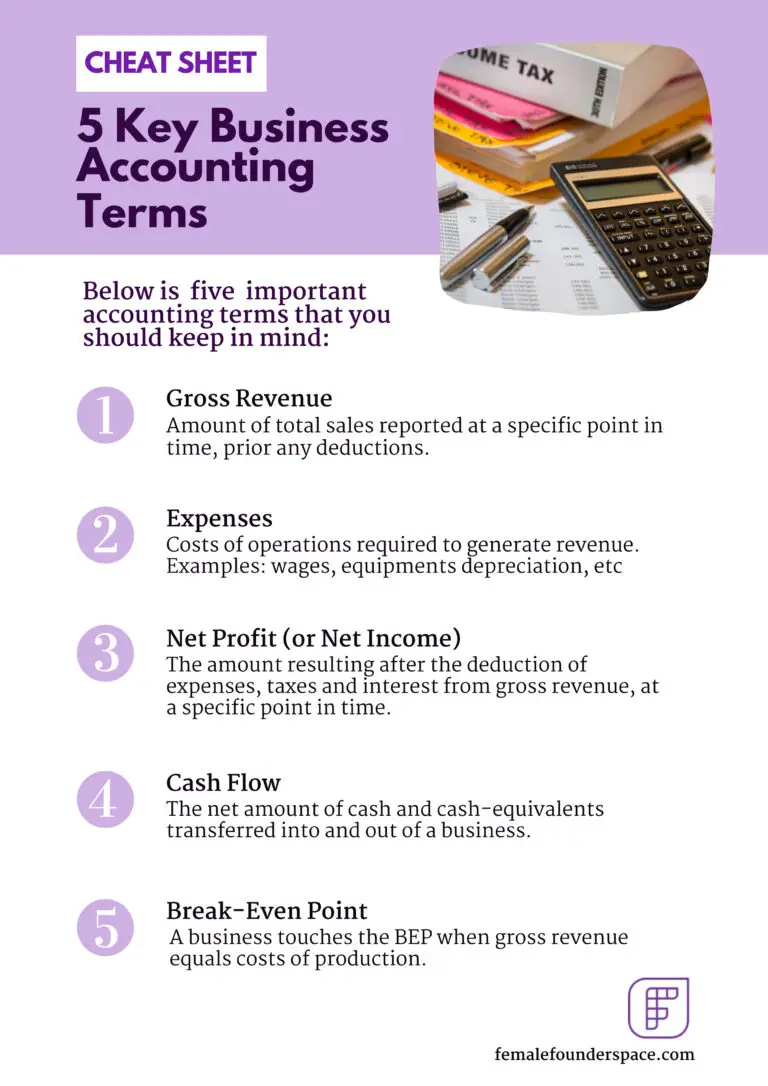

The downloadable cheat sheet below will provide you with a list of the 5 key accounting terms, as well as the 4 main accounting documents that every founder should know.

Make Sure You Are Supported In The Right Way

If you don’t have any experience with finance and for different reasons you cannot learn how to really do it properly, you may want to ask for help to set everything up. For example, you could hire a Business Accountant to keep track of everything for you. Another possibility is to rely on bookkeeping software for small businesses. Here you can find a list of examples:

- QuickBooks is owned by Intuit, which also provides other products of financial support for both small and larger businesses. It is one of the most used cloud-based accounting software because it serves a vast range of businesses. Due to its popularity, it is easy to find tutorials on how to get the best out of it. It is not cheap, but it is certainly one of the most featured accounting software in the world.

- FreshBooks is a cloud-based accounting software designed specifically for freelancers and small businesses. The straightforward interface makes the platform very easy to use for any person. Nevertheless, it also presents plenty of features that will allow its users to fully take control of their finances. You can try FreshBooks with a 30-day free trial.

- Xero is also one of the most popular accounting software, especially due to the relatively cheap price of its Early Plan account. At this price, there are some restrictions such as being able to send a maximum of five invoices. However, these restrictions may not be too heavy for the management of a small business, and users can enjoy this powerful and easy-to-use software for a fairly cheap price.